White paper preview: Unpacking the CleanTech space

Unpacking the CleanTech space - The current landscape and the road ahead in the Nordics

Introduction

Catalyzing the Sustainable Transformation and Investment Growth

The urgency to transition toward sustainable solutions is at an all-time high. CleanTech, once considered a niche, has become a cornerstone of modern economies, driving both environmental development and economic growth. It has captured the attention of policymakers, industries, and investors. Governments are mandating aggressive decarbonization goals, industries are seeking ways to lower their carbon footprints, and investors are pouring unprecedented capital into innovative solutions. For investors, CleanTech represents not only an opportunity for financial returns but also a way to meet growing demands for environmental, social, and governance (ESG) criteria. It sits at the intersection of climate action, innovation, and profitability, where breakthroughs in technology are redefining entire industries.

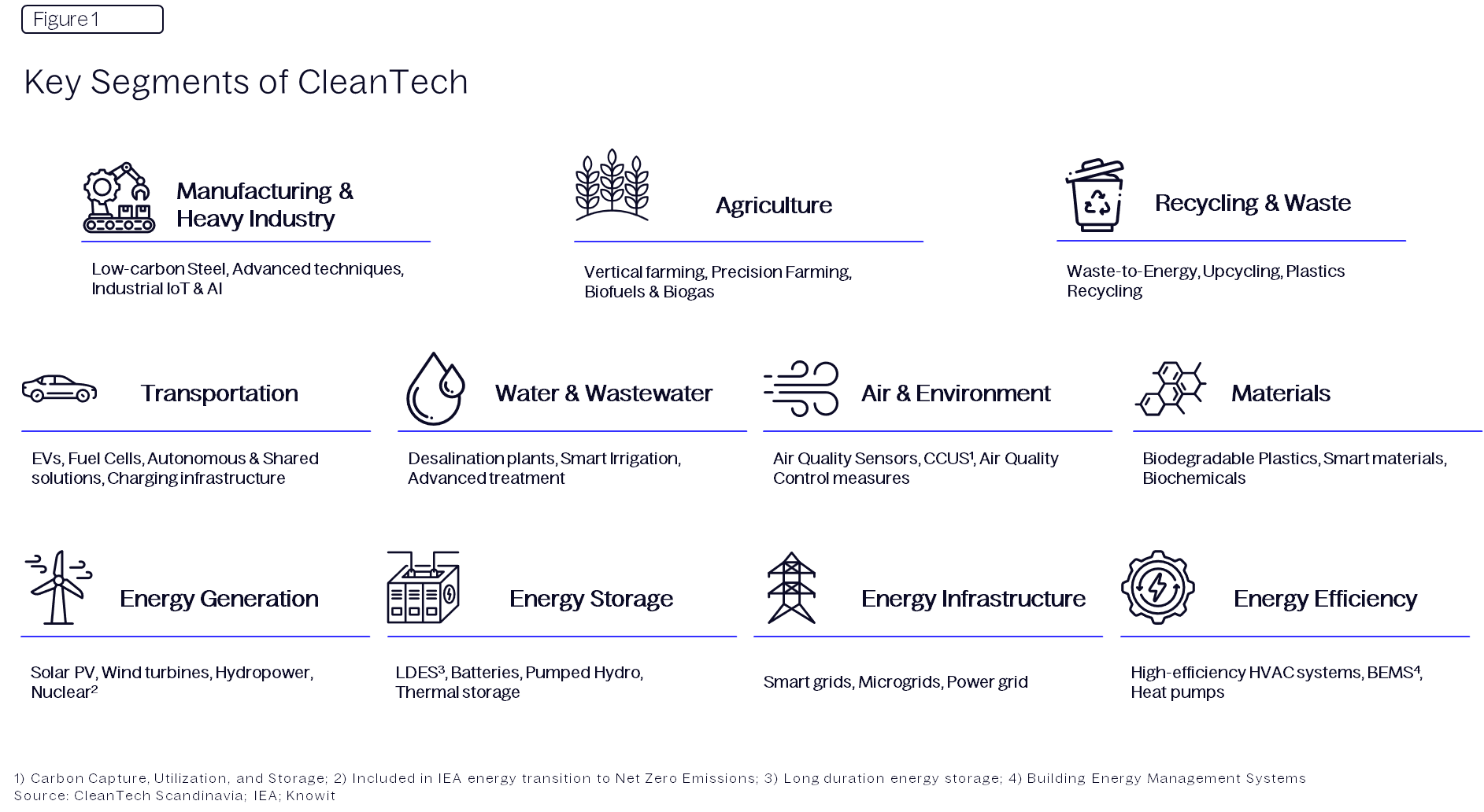

As the world confronts escalating climate challenges, CleanTech has emerged as one of the most crucial sectors for driving the global transition toward a sustainable, Net Zero future. From investors looking for high-growth opportunities to governments crafting policies that promote environmental responsibility, understanding CleanTech and its key segments is essential for achieving climate goals. This report explores eleven key segments within the CleanTech space (Figure 1) that are driving this transformation, detailing how each contributes to reshaping industries toward a sustainable future, providing a high-level review of the investments made so far, and highlighting opportunities for the Nordics as a region.

The global energy transformation is happening, driven by the dual imperatives of limiting climate change and fostering sustainable growth. An unprecedented decline in renewable energy costs, new opportunities in energy efficiency, digitalisation, smart technologies and electrification solutions are some of the key enablers behind this trend. […..] Fortunately, this shift is also a path of opportunity. It would enable faster economic growth, create more jobs, and improve overall social welfare. Reducing human healthcare costs, environmental damages and subsidies would bring annual savings by 2050 of between three to seven times the additional annual costs of the transition. By 2050, the energy transformation would provide a 2.5% improvement in GDP and a 0.2% increase in global employment, compared to business as usual.

Francesco La Camera Director-General, IRENA

Introduction

CleanTech: Catalyzing the Sustainable Transformation and Investment Growth

Section 1

CleanTech and Its Segments: Powering a Sustainable Future

Section 2

The Nordics Position Themselves as CleanTech Frontrunners

Section 3

Investment Needed to Reach Sustainability Targets

Section 4

The Opportunity in the Nordics: A CleanTech Powerhouse

Section 1

CleanTech and Its Segments: Powering a Sustainable Future

CleanTech encompasses a broad spectrum of technologies, products, and processes that aim to improve environmental outcomes while driving economic efficiency. It spans multiple segments, including energy, water, transportation, manufacturing, and agriculture, all of which are critical in achieving the global Net Zero ambitions by 2050. More than just renewables, CleanTech addresses the need for resource efficiency, emission reductions, and sustainable industrial growth. CleanTech, once considered a niche, has become a cornerstone of modern economies, driving both environmental development and economic growth. It has captured the attention of policymakers, industries, and investors. Governments are mandating aggressive decarbonization goals, industries are seeking ways to lower their carbon footprints, and investors are pouring unprecedented capital into innovative solutions. For investors, CleanTech represents not only an opportunity for financial returns but also a way to meet growing demands for environmental, social, and governance (ESG) criteria. It sits at the intersection of climate action, innovation, and profitability, where breakthroughs in technology are redefining entire industries.

This chapter delves into the major segments shaping the CleanTech landscape, highlighting their role in the global push toward sustainability and the substantial investments that are fueling their expansion.

Key Segments of CleanTech

Energy Generation:

The Engine of Clean Growth

Without green energy generation, the vision of a sustainable, low-carbon future collapses. Energy generation is the bedrock of CleanTech, driving innovations that power our cities, homes, and industries. As the world races toward Net Zero by 2050, the green energy transition is critical to reducing global carbon emissions and renewable energy is the main driver to reduce emission considering the 2050 targets. Its contribution is estimated to lower cumulative emission by 35% until 2050.

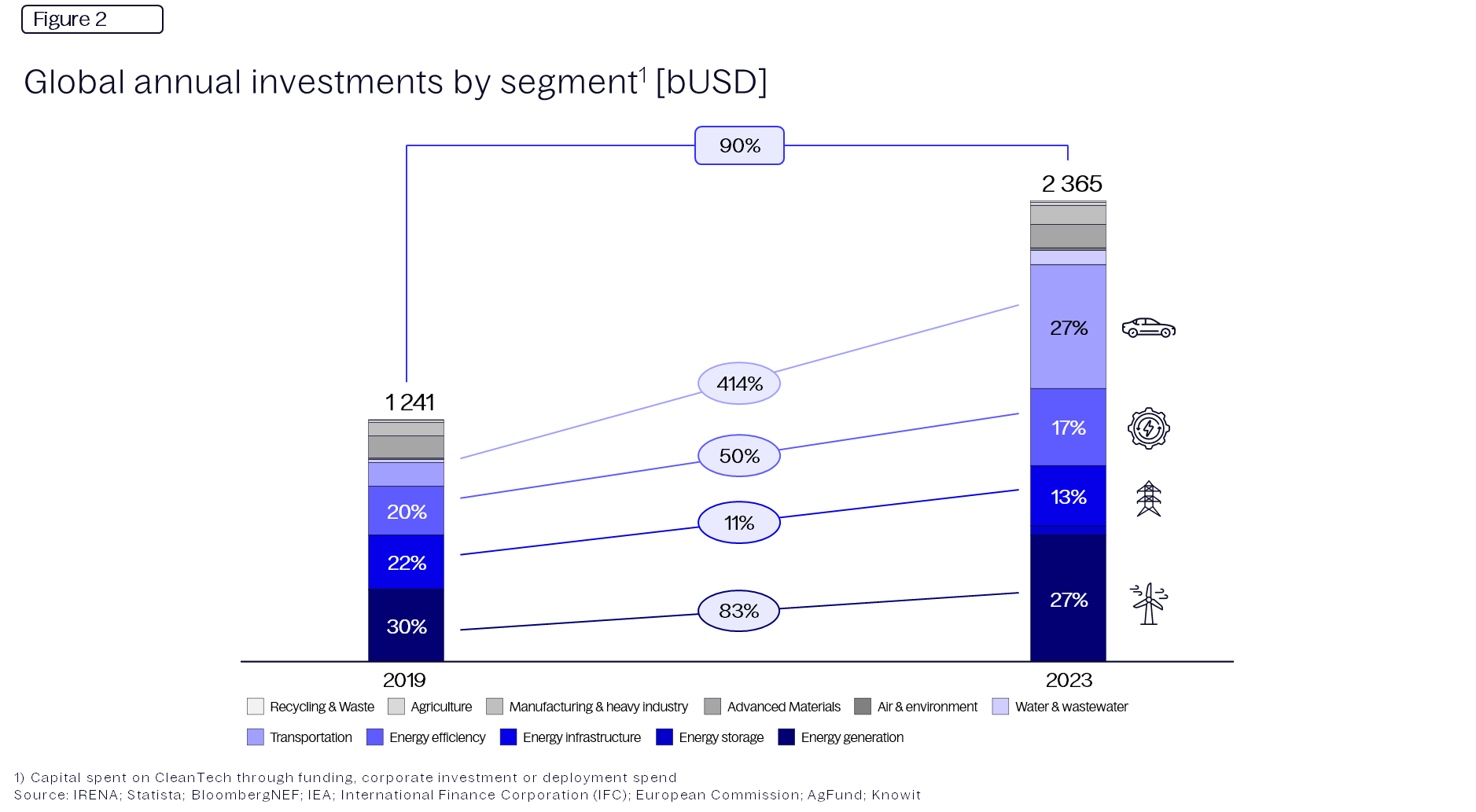

The energy generation segment encompasses technologies that produce electricity or heat from renewable sources such as solar, wind, hydroelectricity, and partially renewables sources like biomass, nuclear. Key Solar players like Scatec and Nordic Solar, alongside wind power leaders like Vestas, are pushing the boundaries of renewable energy capacity. Completing these efforts, especially the transitory phase, players like Metsä Group and Norske Skog have taken an important role in sustainable forestry practice and advancing the bioenergy production. Energy generation is the leading CleanTech segment in terms of investment, attracting over 4.1 tUSD over the last decade. Annual investments reached 650 bUSD or 27% of the total investments in 2023 (Figure 2). With solar and wind energy continuing to dominate, the segment saw accelerated investment growth in 2023, driven by global demand and policy initiatives.

Energy Storage:

Stabilizing the Renewable Supply Chain

While renewables are the future, their intermittent nature presents a significant challenge. Energy storage is the missing piece to this, allowing renewable energy to become as reliable as fossil fuels. Long duration energy storage technologies (LDES) are designed to store and release energy when needed, ensuring a steady power supply regardless of wind or sunshine. Leading innovations include battery storage solutions from companies like Tesla and Saft, and green hydrogen technologies from pioneers like Plug Power and Nel ASA.

As renewable energy generation increases, grid reliability becomes an issue. Energy storage mitigates these challenges by capturing excess renewable energy and releasing it during periods of high demand or low production. This ensures a stable energy supply while enabling an increasing share of renewable resources into the grid.

Energy storage saw a remarkable 76% investment growth in 2023, and has grown by a staggering total of 1300% since 2019, reaching 46.7 bUSD (Figure 2) due to increasing share of intermittent energy, governmental initiatives and regulations, and cost reduction of batteries. Green hydrogen alone secured 10.4 bUSD in funding, growing by 200% in 2023, reflecting its increasing role as a versatile energy carrier for industries that are more difficult to electrify.

Energy Infrastructure:

Building the Grid of the Future

The future of clean energy depends not just on the shift towards renewable energy but on the transformation of our energy infrastructure to handle the complexity and demands of a decarbonized world. The power grid across majority of countries in the world was built for centralized, steady supply from power plants (fossil-fuel-based, nuclear, hydropower, etc.) however today’s clean energy sources like wind farms, solar arrays, and other renewable systems are often decentralized and located in remote areas with highly varied production, destabilizing the grid. This shift requires a new, more flexible grid, capable of integrating diverse energy sources from varied locations like solar farms in deserts, offshore wind farms and highly varied supply.

Leading companies like Hitachi Energy, Prysmian and NKT are spearheading innovations in smart grids and advanced metering infrastructure to enable this transformation. Additionally, growing energy consumption due to electrification of our economies like adoption of electric vehicles, digital infrastructure (e.g., data centers, AI systems) and adoption within the industrial sector requires robust and higher-capacity grids. The total global energy demand is expected to grow by 3.4% annually through 2026, surpassing the annual 2.2% growth observed in 2023.

A modernized grid can stabilize these fluctuations through energy storage systems and demand response technologies, ensuring reliable power even during peak demand or extreme weather conditions. Despite the critical need, investments in energy infrastructure have lagged other CleanTech segments in growth. However, in 2023, the segment attracted 318 bUSD, representing 13% of total CleanTech investment. While this marks a high volume, it’s far from the scale required to meet the future demands of the global energy transition.

Get the full white paper sent to your inbox

Energy Efficiency:

The First Fuel of Sustainability

Transportation:

Electrifying the Road to Sustainability

Water & Wastewater Infrastructure:

Safeguarding Our Most Precious Resource

Air & Environment:

Clearing the Air

Advanced Materials:

Building a Sustainable Future

Manufacturing & Heavy Industry:

Transforming Hard-to-Abate Sectors

Agriculture:

The Digital Revolution of Farming

Recycling & Waste:

Enabling a Circular World

Section 2

The Nordics Position Themselves as CleanTech Frontrunners

A Global context:

The Geopolitics of CleanTech

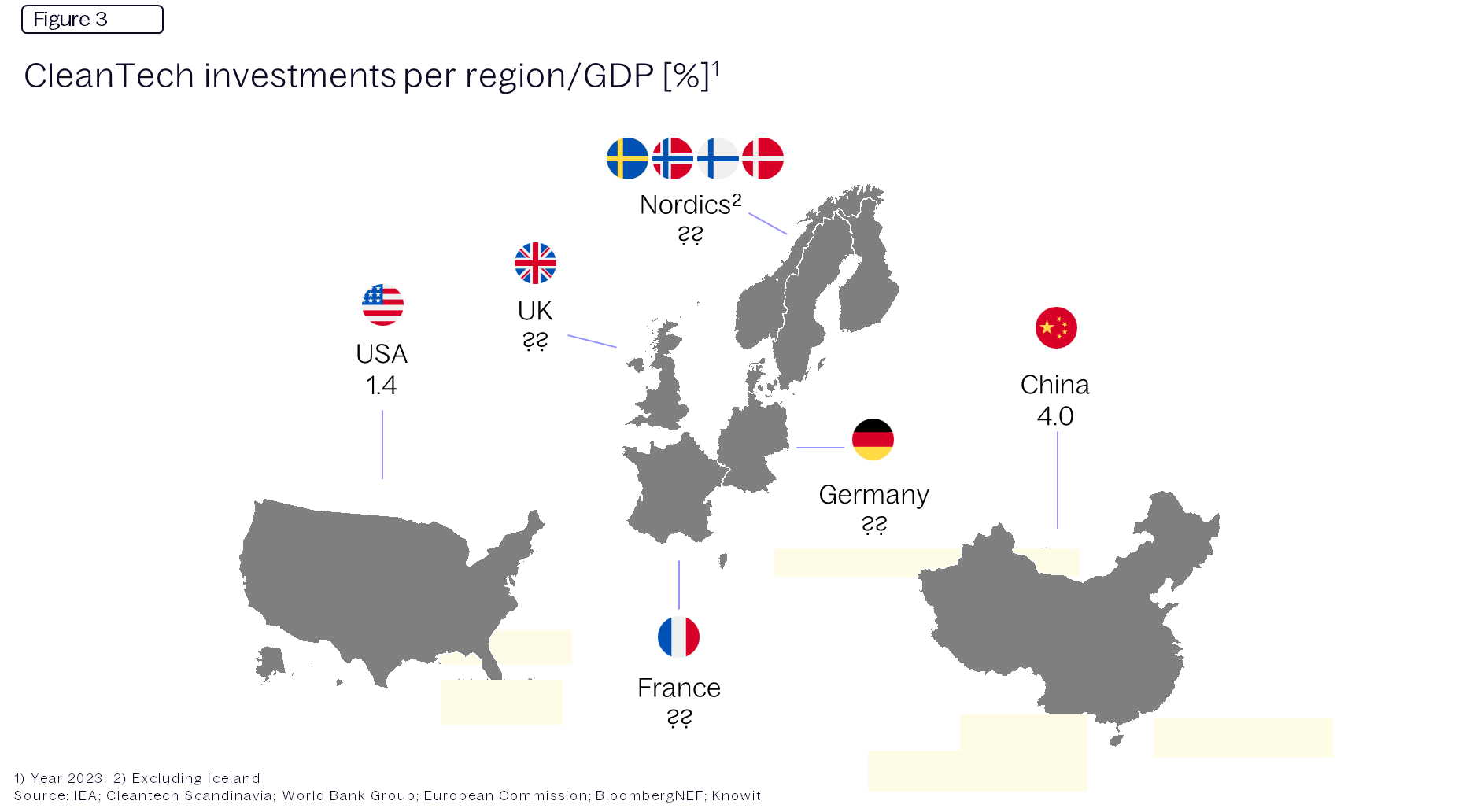

The clean energy race is not just about saving the planet; it’s also shaping global power dynamics. As the world grapples with the climate crisis, regions like China, the US, the EU, and the Nordics are vying to lead the transition to renewable energy. CleanTech is no longer an isolated industry but rather a core component of national strategies tied to energy security, economic growth, and geopolitical influence. China, for instance, has aggressively positioned itself as a dominant force in CleanTech. It accounts for 19% of global GDP, yet remarkably, over 40% of the world’s energy transition investments, at 4% of Chinas GDP (Figure 3). This is largely thanks to its "new three" industries: solar cells, lithium batteries, and electric vehicles. In 2024, China hit its 2030 renewable production target of 1,200 GW ahead of schedule, largely driven by its national “Rooftop PV” program. Despite its rapid expansion of renewables, China maintains investments in fossil fuels for energy security, reflecting a balancing act that many global powers are grappling with.

On the other hand, the United States, while being the world’s largest economy, invests only 1.4% of its GDP (Figure 3) in CleanTech. Nonetheless, the USA leads in advanced materials, investing 50 bUSD in 2023 and accounting for 42% of global investments in the segment. The Inflation Reduction Act (IRA) from 2022 has also laid the groundwork for more significant future investments in infrastructure and renewable energy in the USA.

Meanwhile, Europe, including countries like Germany, the UK, and France, has been leading in hydrogen and, together with China, leads the electrification in transportation. Germany focuses on industrial decarbonization through programs like Carbon Contracts for Difference (CCfD) from 2023, while the UK has set ambitious net zero targets, especially around offshore wind, aiming for 50GW capacity by 2030, and 10 GW low-carbon hydrogen production capacity in 2030.

Get the full white paper sent to your inbox

The Nordics In Focus:

The Green Giants

A Nordic Perspective:

Why They Stand Out

The Verdict:

CleanTech Leadership on The Global Stage

Section 3

Investment Needed to Reach Sustainability Targets

A Critical Turning Point:

The Urgent Path to Net Zero

As the world faces an escalating climate crisis, we are at a critical juncture where action must be taken now to avoid irreversible damage. The urgency to invest in CleanTech is not just a matter of economic opportunity but a necessity to meet ambitious climate targets like Net Zero by 2050. Failing to act risks missing critical benchmarks, exacerbating climate change impacts, and deepening global inequality. In this context, CleanTech investments are crucial. They are the backbone of the shift towards a sustainable future, addressing everything from renewable energy to transportation, water management, and industrial efficiency. However, the gap between current investment levels and what is needed to meet sustainability goals remain immense.

Looking Ahead:

The Future of CleanTech Investment

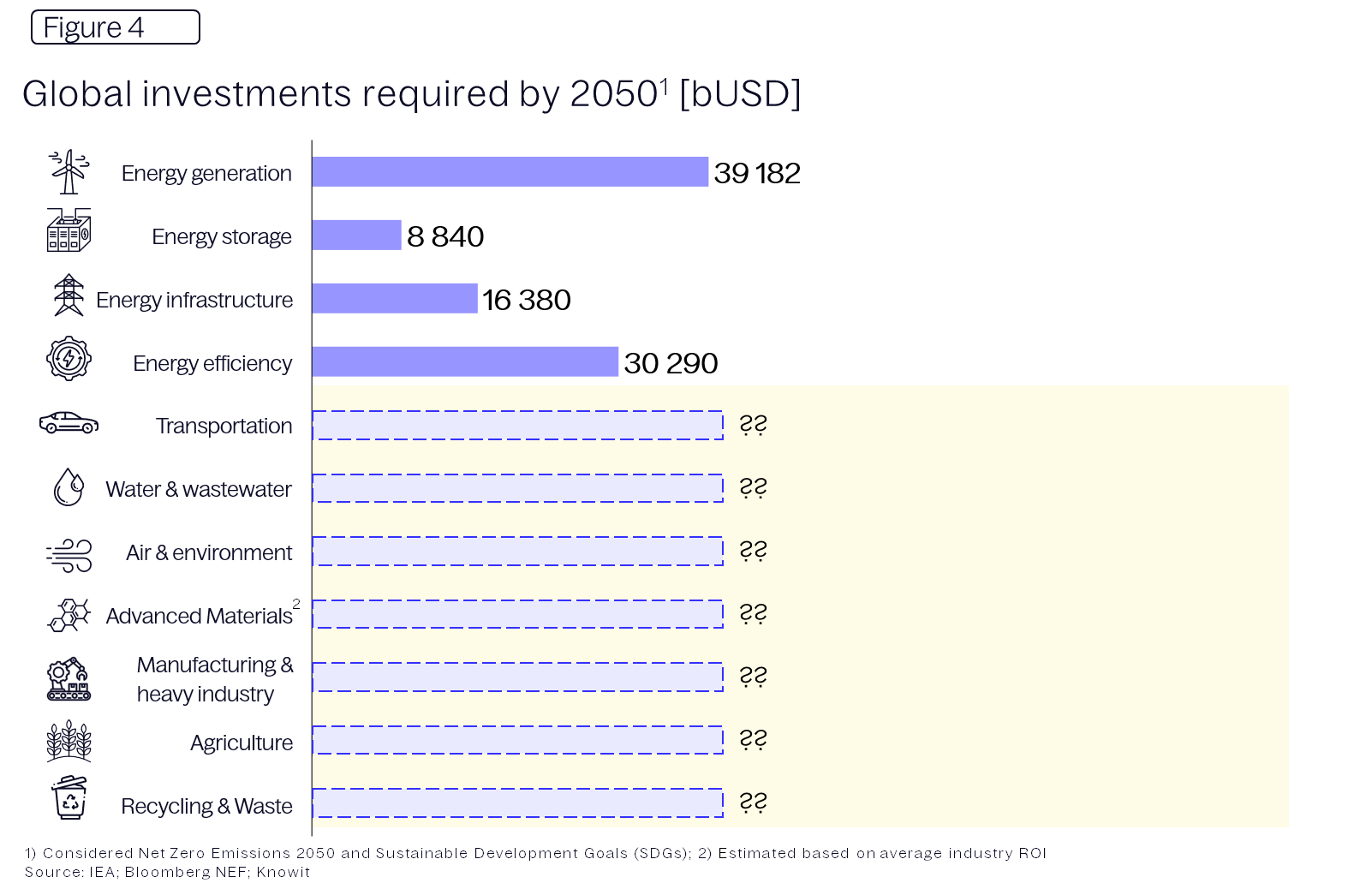

While CleanTech investments have been steadily increasing, they are still far from what is required to meet both the Net Zero 2050 roadmap and the UN Sustainable Development Goals (SDGs). According to current estimates, annual investments across all CleanTech sectors must more than triple to reach around 8 tUSD per year by 2050. This stark difference highlights the need for a global push to accelerate innovation and scale across all sectors.

The transition to clean energy and the modernization of energy infrastructure are key pillars of the global decarbonization effort. To stay on track for Net Zero by 2050, annual investments in energy generation must double to an estimated 1.3 tUSD per year, while energy infrastructure investments will need to reach 700 bUSD per year. These increases are essential to build out enough capacity to meet future energy demands while reducing dependency on fossil fuels. The accumulative investments for energy generation alone are projected to reach 39 tUSD, while energy infrastructure requires 16 tUSD.

Companies like Vestas (wind) and Tesla (solar energy) are already investing heavily in these segments. However, the challenge remains to significantly increase investment flows to match the scale required globally. To sustain the high electricity demand, investments in energy storage must increase immensely. Green hydrogen investments must see an annual increase of 17 times the current level, reaching annual investments of 170 bUSD. LDES annual investments must in turn increase fourfold to an annual investment of 170 bUSD as well, reaching an accumulated investment 2050 of 8.8 tUSD (Figure 4).

Get the full white paper sent to your inbox

Investments Needed Within:

Manufacturing & Heavy Industry

Transportation Shift

Advanced Materials

Water & WasteWater

Agriculture

Recycling & Waste

Section 4

The Opportunity in the Nordics: A CleanTech Powerhouse

A Transformative Moment:

Turning CleanTech into Economic Opportunity

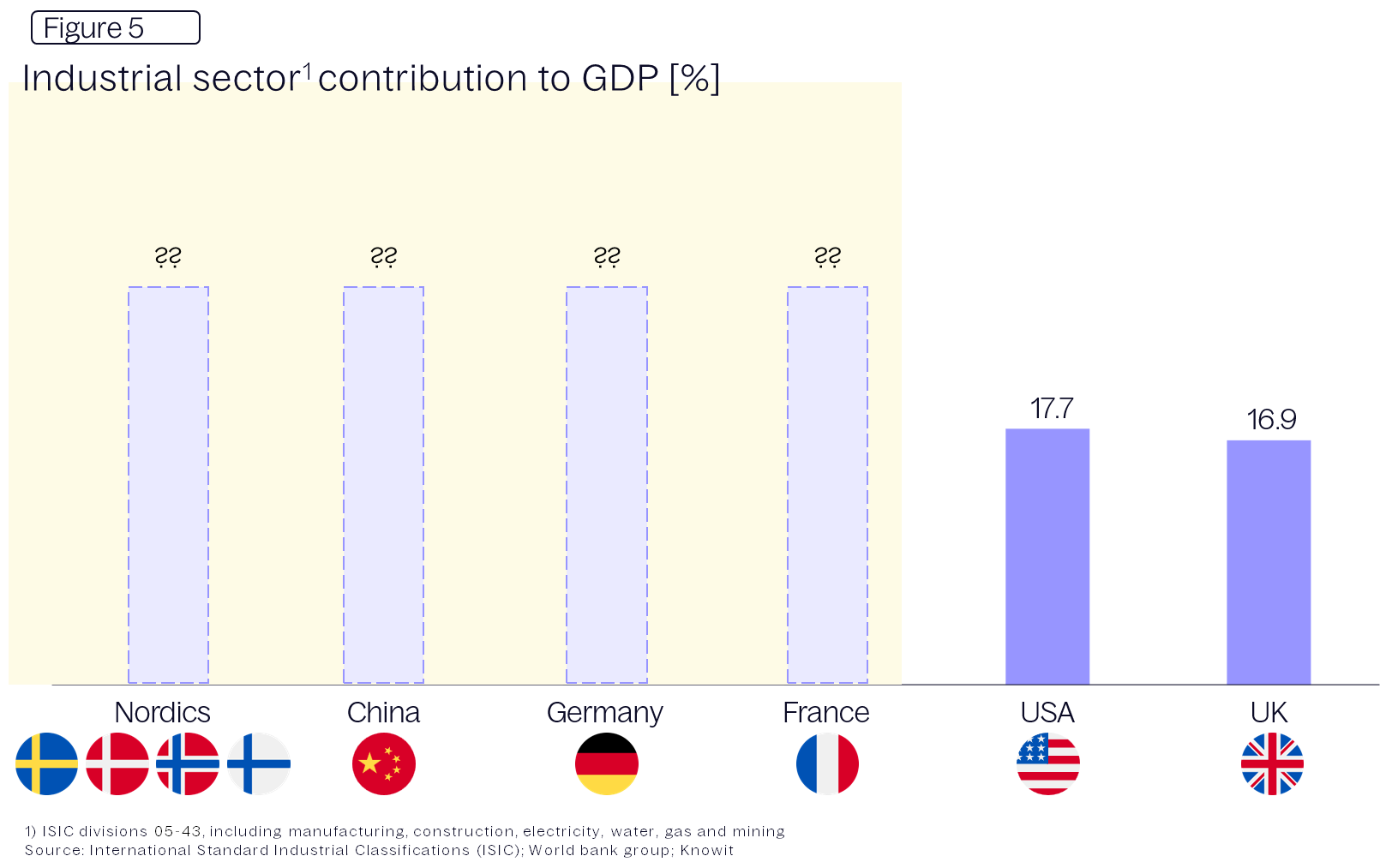

As the global conversation around CleanTech and sustainability evolves, it becomes increasingly clear that this sector isn't just about cost, it's about opportunity. Particularly for regions with high industrial exposure, like the Nordics, CleanTech represents a dual chance to accelerate decarbonization and drive economic growth. For economies with a significant industrial footprint, this shift offers the possibility of capitalizing on existing strengths while meeting the needs of a greener future.

Why The Nordics?

The Promise of Industrial Leadership

Get the full white paper sent to your inbox

Get more insights from our Knowit experts